The Ultimate Guide To P3 Accounting Llc

Wiki Article

Not known Details About P3 Accounting Llc

Table of ContentsThe 9-Second Trick For P3 Accounting LlcMore About P3 Accounting LlcAll about P3 Accounting LlcGetting The P3 Accounting Llc To WorkExamine This Report on P3 Accounting Llc

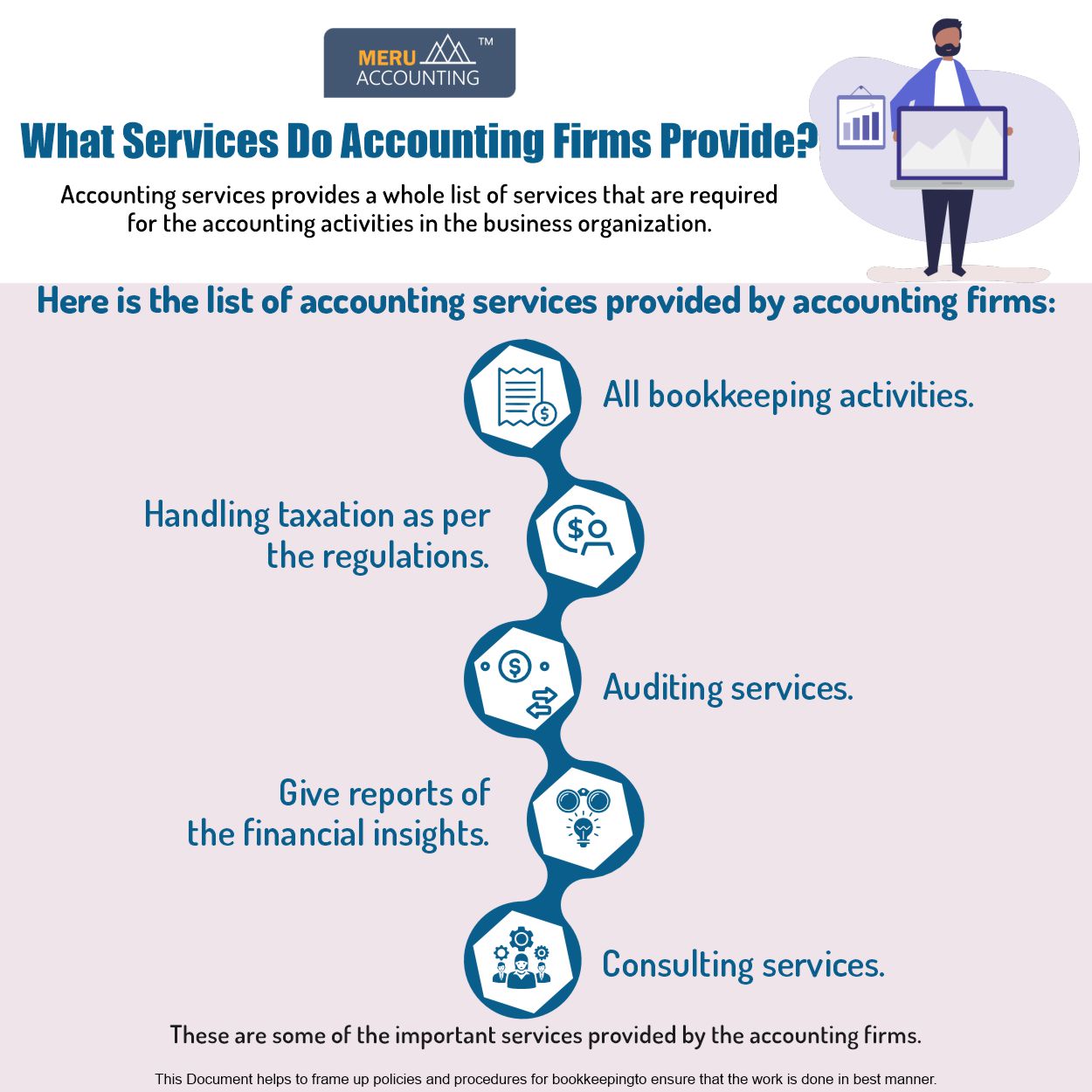

When people consider the accounting field, typically taxes come to mind (business consulting OKC). And while a great deal of CPA's and accounting professionals do function in tax prep work or with income tax return, did you know there are numerous other kinds of accountancy firms in the industry? Accountancy involves a whole lot even more than just tax obligationsJust like the name indicates, an accountancy firm is a team of accountancy professionals that supply tax resolution, accounting, bookkeeping and consultatory services (plus a selection of various other solutions) to paying customers. https://slides.com/p3accounting. CPA's, or certified accountants, can operate at companies like these however not every accountant is a certified public accountant however every CPA is an accounting professional

Certified public accountant's have to stay on top of CPE (proceeding professional education and learning) credit ratings too to preserve their permit. There are different kinds of bookkeeping companies, consisting of: Public Private Government 1. Full-Service Audit Firms Normally, a full-service bookkeeping firm gives a large variety of solutions from tax obligations to consultatory to audits, and much more.

P3 Accounting Llc for Dummies

These techniques have the resources needed to offer a complete collection of services, therefore the name full-service. 2. Tax Companies Tax Obligation Firms are a specialized kind of accountancy companies which concentrate almost solely on tax obligation preparation, planning and resolution for companies and people. Accounting professionals functioning at these firms are typically CPAs and it's critical for them to stay up-to-date on tax legislations.

Accounting Firms Bookkeeping firms are concentrated on record-keeping and maintaining track of income, expenditures, payroll and for some, tax obligation returns for business customers. Which type of audit firm do you work at?

P3 Accounting Llc Can Be Fun For Everyone

It is essential to have a precise and reliable audit and monetary coverage process to aid you. The advancement of a reliable services version called client accounting solutions offers automated modern technology and budget-friendly accounting advice to assist your business grow.Under CAS, a remote team of specialists (from a firm that supplies CAS) works as an integral component of your company and has a much deeper understanding of your company. Firms provide client audit services in a number of varieties based on your business demands. Some handle just transactional solutions, while others assist you with all your audit needs, including transactional, conformity, efficiency, and critical services.

Right here are several of them. While many company owner acknowledge the requirement for an experienced bookkeeping specialist on their group, the cost of employing a full time staff member for economic reporting may not be practical for every person. When you hire a worker, you are not just paying salary and benefits like health and wellness insurance policy, retirement, and paid-off time however are additionally dealing with FICA, unemployment, and various other taxes.

Some Known Details About P3 Accounting Llc

As your organization expands and your monetary demands change, a specialist customer audit providers will certainly modify their services to meet your organization needs and use far better adaptability. Need to review You might make most service choices based on basic observations and reaction, but having numbers in your corner is an excellent means to support your resolutions.

CAS accountants understand your business inside and out. https://p3accounting.blog.ss-blog.jp/. They can additionally use an individualistic perspective on accounting methods and growth obstacles and help you make educated decisions to overcome them. Among the benefits of collaborating with a firm that uses client accountancy services is access to the most up to date accounting software program, automation methods, and innovation changes that can enhance your service

The Facts About P3 Accounting Llc Uncovered

The group you deal with may be software program specialists skilled in sophisticated software features like Intuit Quick, Books, Microsoft Dynamics 365, Sage, or Web, Collection. Or, they might be generalists who can carry out basic bookkeeping tasks on any software program. Audit and accounting can derail your focus from what's even more vital to your organization, specifically if it is not your favorite.A survey conducted among 1,700 firms that contract out accountancy showed that CAS saves time on total service procedures. With the ideal individuals, systems, and procedures at hand, you can optimize capital, make the most of earnings, handle investments, and develop service expansion versions as effectively and rapidly as feasible. Need to read Unfortunately, fraud is just one of the inevitable occurrences every service deals with.

Report this wiki page